|

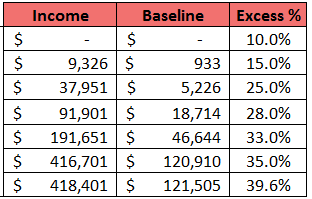

Moving up the ladder? The tax bracket ladder? Well, how about moving up the retirement savings ladder, without having to move up the tax bracket ladder? Interested? Good, because this is something you can start doing today, which is, allocating more of your paycheck to your 401K. And then if eligible, your IRA. Because folks, you can reduce your MAGI (Modified Adjusted Gross Income) by $17,500 (and more if you double down with an IRA). And all of this is just another way of saying that your income can be at “x”, but you can pay taxes with a lower value of “y”. Before we can continue, let us see the most recent year's Tax Bracket Ladder for an individual: Now let us assume you make $92K. And your MAGI is $92K (you didn’t put anything into retirement). With the current tax structure, you owe:

1. 28% of the excess of $91,901, being $28 2. $18,713.75K of the baseline tax, for being in that tax bracket level 3. Total taxes are $18.7K 4. Your Retention Income After Taxes (RIAT) is 79.6%, and no savings for retirement 5. Net Income After Taxes: $73.3K Now let us assume with the same $92K salary, you put $17,500 in your 401K. Your PTL (Personal Tax Liability) base is now at $74,500. With the current tax structure, you owe: 1. 25% of the excess of $37,951, being $9.1K 2. $5,226.25 of the baseline tax, for being in that tax bracket level 3. Total taxes are $14.4K 4. Your Retention Income After Taxes (RIAT) is 84.4%, with $17,500 in savings 5. Net Income After Taxes: $60.1K Now, Next Step: You have a Retirement Plan Coverage at work. We have already established that in the above example. But, what are the implications for a possible IRA deduction. So as per the most recent year according to the IRS, to be eligible for a full deduction of your IRA disbursement, you must have a MAGI no greater than $62K. For simplicity purposes, let us assume you do not have enough deductions to get to $62K. But you are still able to have partial deductions below $72K. Now from making $92K, you can get to pay taxes at a base below $70K. Therefore, if you contribute the max of $5.5K (if you are below 50) or $6.5K (if you are above 50), you can further reduce your tax liability, save more for your retirement, and have a higher RIAT. One last quick note on this section, if you are not covered with a 401K plan at work, you can deduct all $5.5K or $6.5K, without a salary ceiling. Bottom Line: With maxing out your 401K (and potentially an IRA), you end up keeping more of your money in the long run, plus $17.5K of annual savings (and up to $24K depending on your IRA status). The tax system, as illustrated above, does not incentivize people to be “upper middle class”, in relation to your MAGI. Because as shown in the example, at the end of the day, someone could end up being more financially solvent, while making $17.5K to $24K less in salary, as stated in their tax forms.

0 Comments

Leave a Reply. |

Archives

June 2019

Categories |

RSS Feed

RSS Feed